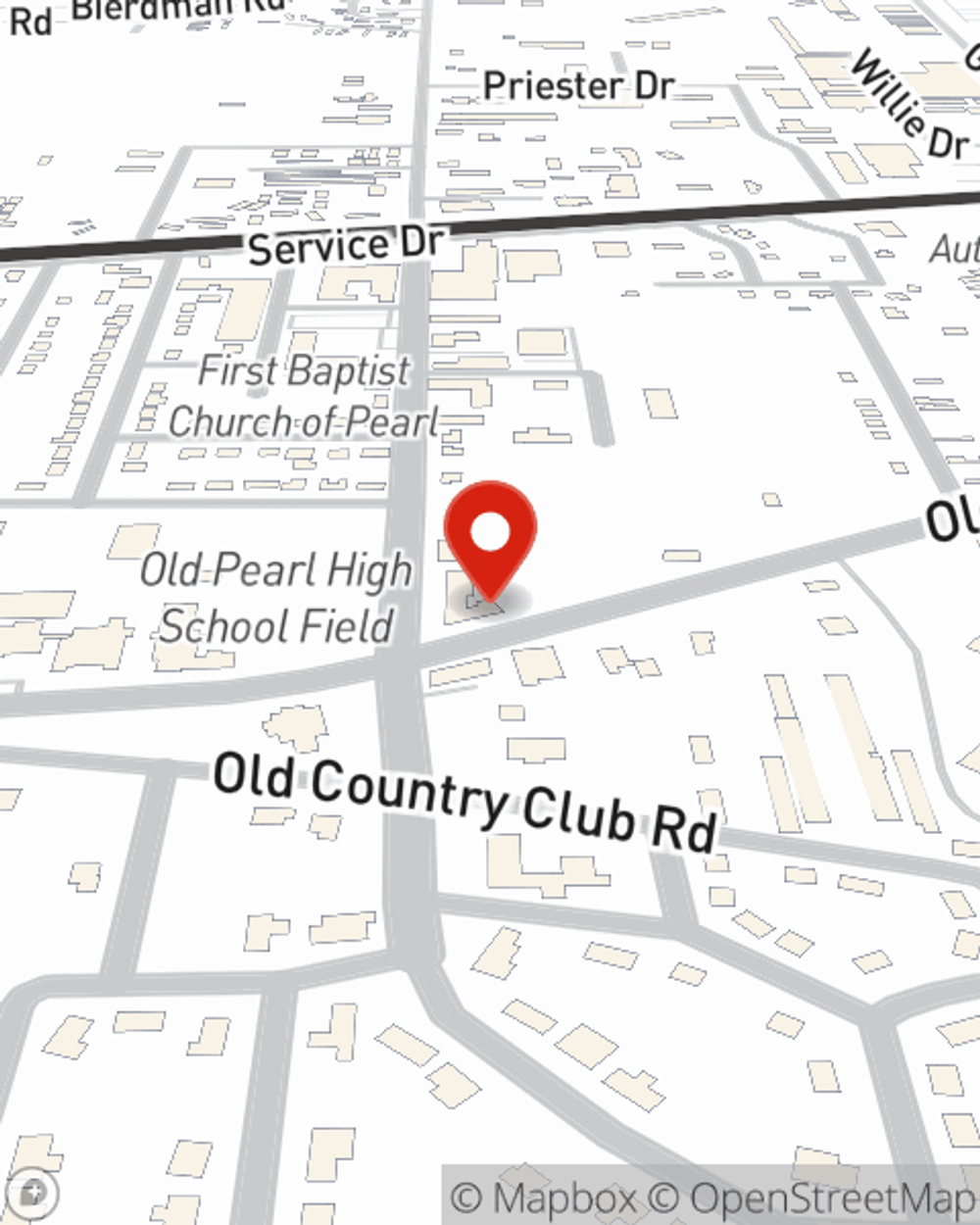

Business Insurance in and around Pearl

One of Pearl’s top choices for small business insurance.

Cover all the bases for your small business

Help Protect Your Business With State Farm.

As a small business owner, you understand that the unexpected happens. Unfortunately, sometimes accidents like a customer stumbling and falling can happen on your business's property.

One of Pearl’s top choices for small business insurance.

Cover all the bases for your small business

Small Business Insurance You Can Count On

Our business plans rarely account for every worst-case scenario. Since even your most detailed plans can't predict consumer demand or global catastrophes. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for uncertainty with a State Farm small business policy. Business insurance covers your business from all kinds of mishaps and troubles.. It protects your future with coverage like a surety or fidelity bond and business continuity plans. Terrific coverage like this is why Pearl business owners choose State Farm insurance. State Farm agent Jason Quin can help design a policy for the level of coverage you have in mind. If troubles find you, Jason Quin can be there to help you file your claim and help your business life go right again.

Don’t let fears about your business stress you out! Contact State Farm agent Jason Quin today, and see how you can benefit from State Farm small business insurance.

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Jason Quin

State Farm® Insurance AgentSimple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.